Taxes & INCENTIVES

Owasso businesses benefit from Oklahoma’s standing as the state with the lowest business tax burden (Source: Anderson Economic Group, LLC, 2018). Oklahoma has very low property and unemployment compensation taxes, and an above-average severance tax.

Low Taxes Make Owasso a great Value

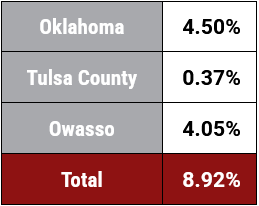

Sales Tax

Municipal governments in Oklahoma derive their operating budget primarily from sales and use tax, permit fees, service fees, grants, and fines. Highways and convenient access roads funnel traffic through Owasso, making Owasso a natural choice for many retail operations. Sales tax collection from these retail sources allow the city to better support existing businesses and to encourage additional growth.

Owasso property tax

PROPERTY TAX

Property taxes are the main source of non-grant revenue for school districts, counties, and career-tech systems. Cities may only use ad valorem (property tax/millage) taxes to pay the debt on bonds approved by voters and judgments against the City. Owasso has no general bond indebtedness and does not receive ad valorem taxes for city operations. For businesses, property taxes are based on the assessed value of the tangible property: furniture, fixtures, equipment, and inventory that one ones on Jan. 1 of the current tax year.

Manufacturing Exemption

Certain new or expanding manufacturing or research and development facilities may qualify for a five-year exemption from property taxes.

City millage rate comparisons

Freeport Exemption

Some business inventories may be exempted from property taxation in whole or in part if not detained in Oklahoma more than nine months.

Other Taxes in Owasso

The City of Owasso collects a 2% franchise tax on utilities, a 5% hotel tax, and state-shared revenues taxed on telephones, alcoholic beverages, tobacco, and gasoline.

Tax Increment Financing District

The City of Owasso established the Redbud District TIF (Tax Increment Financing) to support revitalization and development in downtown Owasso. As new businesses move into the district and redevelopment progresses, property values are expected to increase. The original tax base continues to fund local services, while the additional tax revenue generated from rising property values — the “tax increment” — is set aside specifically to fund redevelopment efforts within the district.

For more information, visit the District's Website.

INCENTIVES

The City of Owasso is dedicated to fostering high-quality development and enhancing the quality of life for its residents. Our incentive programs may include tax abatements, infrastructure improvements, fee waivers, loans, and other benefits, particularly for target industries. To explore potential incentives that could reduce your business costs, contact Owasso Economic Development at 918-376-1500 or email swingert@cityofowasso.com.

Oklahoma has some of the lowest tax rates and some of the best tax incentives in the nation. The state offers companies a low cost of doing business, a low cost of living for employees, and tax rebates that reduce tax burdens even further. The Oklahoma Team will also help you identify all state and local incentives applicable to your project. Call 800-588-5959 for your no-cost incentives analysis.

Click here for the Oklahoma Business Incentives & Tax Guide to learn about other incentive opportunities.

Oklahoma Quality Jobs Program

This program provides quarterly cash payments to a qualifying company of a percentage, not to exceed 5%, of newly created gross taxable payroll. Special provisions are made for certain small employers in rural counties or other specially designated locations.

Foreign Trade Zones: Tulsa International Airport & Tulsa Port of Catoosa

Businesses engaged in international trade benefit from special customs procedures when exporting, warehousing, manufacturing, or assembling with imported goods in Foreign Trade Zones.

Oklahoma Enterprise Zone, Portions

Additional incentives may be available to firms locating within Enterprise Zones. These include designated counties, cities, or portions thereof and are based on the relative economic health of the area and other factors.